Starting a new business is more than an idea. Indeed an idea is required, but there are several other things that you need to let your product/service and business work like CIN number, Tin number and GST registration.

Besides, there is also a need to bring transparency for which several rules and regulations are being laid down. Every business owner is required to adhere to them.

One of these rules is registering the business as a company and getting a Corporate Identity Number (CIN).

So, if you too are on the verge of starting your own company, it is vital for you to know about the CIN number registration to help yourself with smooth transactions. To begin with, let’s first understand in-depth what CIN number is.

Table of Contents

What is CIN Number?

Cin Full Form is a Corporate Identification Number. CIN Number is a unique 21-digit alphanumeric number provided to all One Person Company, Private Limited Company, Section 8 Company, Limited Company, Producer Company, and Nidhi Company registered in India.

The CIN number means is Corporate Identity Number which is used to track all the aspects of the company. The Registrar of Companies (ROC) of the states under the Ministry of Corporate Affairs (MCA) issues the CIN number.

Every Indian state and Union Territory has at least one ROC except the North Eastern States. The ROC is primarily responsible for the change of the names of the companies, actions taken against the default companies, conversion of the companies from the public to private and vice versa, etc.

The concerned ROC issues a certificate with a unique CIN code and approved name after the formation of a company.

The CIN no. reveals the identity and basic information of the company. The number also helps in finding the authenticity of the business.

In this post, we will discuss what the CIN number is, its importance, how to get it, and where it is required.

Also Read: LLP Registration in 5 Easy Steps: A Comprehensive Guide

Types of Business Structures in India

- Limited Liability Partnership (LLP): it is a separate legal entity where all the partners have limited liabilities. Their liabilities are limited to their contribution. Here, one partner is not liable or responsible for the misconduct of the other.

- One Person Company (OPC): it is one of the best ways of starting a company these days. If there is only an owner or promoter, OPC enables him to commence his business as a sole-proprietor and still be in the corporate framework.

- Private Limited Company (PLC): here, the owners are separate from the company in the eyes of the law. All the individuals, such as directors (company officers), shareholders (stakeholders), etc. are regarded as company employees.

- Public Limited Company (PLC): a voluntary association of members under the Company Law is PLC. The liability of the members is limited to their shares.

What is the Importance of CIN Number?

CIN number use to track the aspects of the company and must be provided on all the transactions with the respective ROC.

The Corporate Identification Number means the basic information about the company. In other words, each digit of the alphanumeric can be easily translated into important information related to the company.

And so, the Corporate Identification Number is used to find the details of the company registered under the MCA. Various details can be identified and tracked by the information ROC/MCA holds about the company with this number.

Also Read: Why Trademark Registration Is Important For Your Business?

What is the Format of Corporate Identification Number (CIN)?

Also Read: What is NSIC and NSIC Registration Procedure?

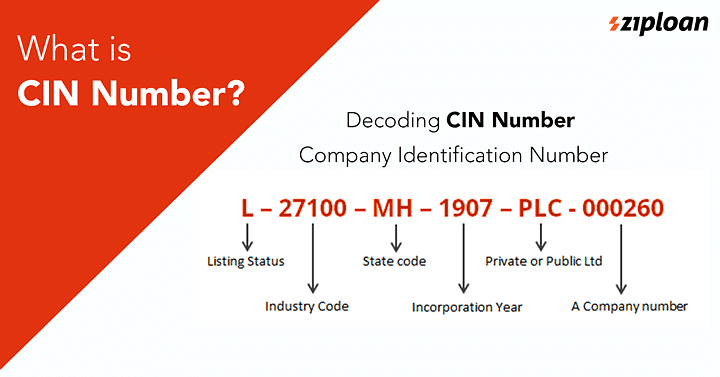

The CIN number is a 21-digit number with each number displaying some information about the company. The format of the Corporate Identification Number is as follows:

-

Listing Status: The first letter of the number represents if the company is listed or not listed. It is U for unlisted status and L for listed status.

- Industry Code: The next 5 digits of the number represent the ROC industry code. All different activities have different 5-digit code and this code is used to identify the type of company. A few examples of the same are as follows:

| S.No. | Activity | Activity Code |

| 1 | Hospitals | 85110 |

| 2 | Real estate activities on a contract basis or fee | 70200 |

| 3 | Freight transport by motor vehicles | 60231 |

| 4 | Retail sale of construction materials | 52341 |

| 5 | Manufacture of mineral water | 15543 |

| 6 | Farming of sheep, cattle, goats, asses, horses, hinnies, mules, dairy farming | 01211 |

| 7 | Production, supply, and documentation of ready-made software | 72211 |

| 8 | Activities of travel agencies and tour operators | 63040 |

- State Code: The 7th and 8th place represents the state code of the state in which the company is incorporated. If the company is incorporated in Tamil Nadu or Maharashtra, the 7th and 8th digit will be TN or MH respectively.

-

Incorporation year: Digits from 9th to 12th place represent the year of the incorporation of the company.

-

Ownership Type: After the incorporation year, the next three characters represent the ownership type of company – PLC for Public Limited Company and PTC for Private Limited Company.

-

Registration Number: The last six digits of the CIN number are the registration number of the company issued by ROC. Notably, the LLPs in India do not have CIN and they instead use LLPIN.

Where Can You Mention Corporate Identification Number?

The Corporate Identification Number is to be mentioned in the following documents:

- Receipts

- Invoices

- Letterheads

- Notice

- Annual Reports

- All e-forms on the portal of the Ministry of Corporate Affairs

- Emails to parties who are not a part of the company

- Publications such as journals, books, periodicals, financial results, etc.

Bill heads - Business letters

If the businessmen do not adhere to the above-mentioned requirements, then the penalty levied is INR 1000/day. The maximum penalty, however, is INR 1,00,000.

Also Read: Udyog Aadhaar Registration: How to do it Online?

How to get CIN Number?

Also Read: What is the Difference Between PAN, VAT, TIN, TAN, DSC, & DIN?

The Corporate Identification Number is automatically allotted after the company is incorporated and approved by the ROC – Registrar of Company. So, there is no need to apply for CIN number.

ROC or Registrar of Companies is a government institute that functions to incorporate or register companies. It is situated in all the respective Indian states and Union Territories.

The main objective of the Registrar of Companies is to ensure that all companies in India comply with statutory requirements. The other objectives of ROC include:

- Change of company names

- Actions against the default companies

- Conversion of companies from private to public

When to Change CIN Number?

The Corporate Identification Number can be changed in the following cases:

- Change in the listing (Listed or Unlisted) status of the company

- Change in location or state of the company’s registered office

- Change in sector/industry of the company

Also Read: Do we still require Service Tax Registration After GST Implementation?

How can you Track CIN Number?

You can easily find company details by CIN number online. To track or check your company’s registration number, visit the Ministry of Corporate Affairs website.

On the website, you can search CIN number to find whether the organization is a company or limited liability partnership, and based on any of the following:

- Company registration number; or

- Existing Company’ name or the name of the Limited Liability Partnership; or

- Inactive CIN; or

- Name of old company or the name of the Limited Liability Partnership

After filling out the required details, you need to enter a captcha code and click on search.

Penalty

There is a penalty of Rs. 1000 per day when CIN no is missing in important documents business letters, billheads, letter papers, and in all its notices and other official publications as necessitated by section 12(3) of the Companies Act, 2013. The penalty cannot exceed Rs. 1,00,000, as mentioned in section 12(8) of the Act.

Frequently Asked Questions

CIN number means Corporate Identification Number sometimes referred to as CIN is a unique identification number that is assigned by the ROC (Registrar of Companies) of various states under the MCA (Ministry of Corporate Affairs).

You can obtain CIN by procuring a Digital Signature Certificate (DSC), Director Identification Number (DIN), getting the name approved and by filing documents of incorporation which includes the Memorandum of Association and Articles of Association of the Company.

CIN stands for Challan Identification Number. It is a 17-digit number that is 14-digit CPIN plus 3-digit Bank Code. CIN is generated by the authorized banks/ Reserve Bank of India (RBI) when payment is actually received by such authorized banks or RBI and credited in the relevant government account held with them.

CIN no. is used to track all the activities of an enterprise after its registration by RoC. This number contains the identity of an organization and additional information regarding the registered company under RoC. The company’s information can be accessed using 21 digit alphanumeric unique identification number by RoC.

The CIN is the first nine characters of the identification number located on the front of the member’s Benefits Identification Card (BIC).

The last six numbers of CIN number is the registration number of the company issued by the Registrar of Companies. Note: LLPs do not use CIN. LLPs are provided with LLPIN. Also, a company’s CIN will not be the same as its GSTIN.

Corporate Identification Number or Corporate Identity Number CIN is a 21 digit alpha-numeric number provided to all One Person Companies, Private Limited Companies, Companies owned by Central or State Government of India, Not-for-Profit organizations, etc.

CIN is the abbreviation for Challan Identification Number. This has three parts – 7 digit BSR code of the bank branch where tax is deposited. – Date of Deposit (DD/MM/YY) of tax – Serial Number of Challan. The CIN would be stamped on your acknowledgment receipt to uniquely identify your tax payment.

CIN i.e. Challan Identification Number is a 17 digit number generated when a challan is paid. Thus, CIN is generated after the payment of GST. It comprises of 14 digit CPIN and 3 digit bank code. CIN is used to track the status of GST Challan, whether paid or unpaid.

You cannot change the CIN no., however, it will automatically change when there is a change in listing status, location of registered office, or the industry of the company.

To do CIN verification visit MCA website, and in the Master Data, click on “View Company or LLP Master Data.” Enter the CIN Number and Captcha code and submit the page.

A corporate identification number for a proprietorship is required. Because corporate identification numbers are only applicable for companies incorporated under the companies act.

If you have the corporate identification number of the company that you wanted to check, leave blank for the “Company / LLP Name” field and enter the CIN No. straight into the field against “Company CIN / FCRN / LLPIN / FLLPIN”. Then enter the captcha characters into its field, then submit. There you can find the data you are waiting for.

Related Posts

thankyou so much for sharing this piece of information. CIN is something unknown to many people this article is one which makes people familiar with CIN and its importance. keep writing. hope to read many more informative articles in future.