There is no second thought that a good CIBIL score is key to loan approval. Whether you are opting for a business loan or a home loan, the lender would certainly check your CIBIL or credit score. It is an important eligibility criterion of the loan application process.

If you are keen on securing an easy business loan, then the best is to make your CIBIL Score good. The best score the bank and NBFCs will look into is 700 or more out of 900. Less than that will bring down the chance of getting a business loan.

However, it is important that you must know how to check the CIBIL score online.

Thankfully, online finance lending companies have made it easy to find credit score online. Once you know the CIBIL score for a business loan, you can go ahead to apply for the same.

Let us first check what the CIBIL score or credit score is.

Table of Contents

What is a CIBIL Score?

A credit or CIBIL score is like “points” which is given by the lender or a finance institute when you repay the loan on or before time. The score calculation is based on the credit report. You can calculate the CIBIL score online to know where you stand.

Following are the benefits of earning high CIBIL Score:

- Helps in getting Loan Approvals: When you opt to apply for a small business loan from any finance institute, the lender will check the credit history during evaluation. The best way is to calculate the CIBIL score online and know if there is any chance of loan application being rejected. If your CIBIL score is high, then the lender will find you safe to lend money. In case if your score is less than the mentioned number, then there is less chance of getting approvals on loan application.

- Avail Loan in Low Interest: Every borrower looks for a low business loan interest rate. However, the interest rates for the business loan depends on the lender to lender. If you got a good credit score, then there is a good chance of getting a low interest rate loan.

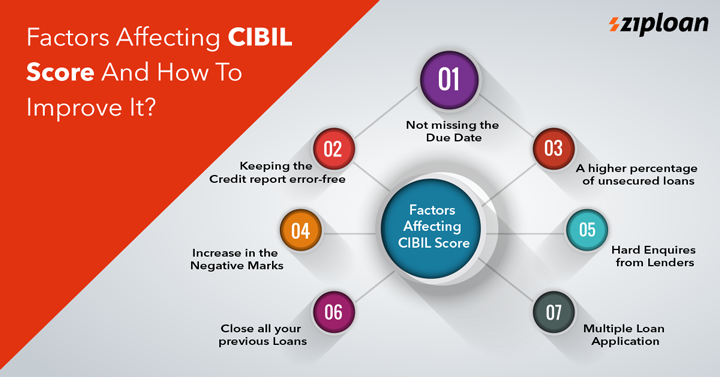

Let us now check some factors affecting your CIBIL score.

Not missing the Due Date

One of the critical factors impacting your CIBIL score is a timely payback of the loan. Missing the due date of credit card bill, not paying the EMI on time can have a significant impact on your credit history.

The credit history presents you with complete details about the due date remaining for unpaid EMIs. Therefore, the best thing to do is keep-paying bills on time. Similarly, you can also pay back the loan on time.

Multiple Loan Application

There are times when you will need multiple loans to fill your credit requirements. This leads to getting deeper into the loan repayment, which sometimes becomes difficult.

The lending company does proper scanning of your CIBIL report to check how many loans you borrowed and if the repayment is made on time?

If you are applying for loans with more than one finance company, then you are tagged as credit hunger. Therefore, it is better to limit your loan application, which will also bring your credit burden down.

Increase in the Negative Marks

Many things can demote negative marks- foreclosure, accounts in collections due to defaults in payments, ‘Written Off’ or ‘Settled’ status on a past loan, etc.

If you have high negative marks, then there is a huge possibility of rejection in the loan. Negative remarks also represent that you are unable to manage your credit.

To bring down the negative marks, it is important you manage your credit finely by proper planning.

Hard Enquires from Lenders

Hard enquires happen when the potential lender accesses your CIR to determine if you are eligible for a particular loan. If the business loan amount is enormous, the creditor will make a hard enquiry before approving the loan.

This will also marginally bring down the credit score denoting you need credit and are applying to several lenders.

Therefore, to bring down the chances of getting loan application disapproved, it is essential to apply to a lender whose all terms and conditions you meet and not to multiple lenders.

Never Increase your Credit Card limit frequently

Although the increase in the limit on a credit card will give you the flexibility to gain more debt. However, this can affect your credit score in the long term.

The frequent increase in the credit card also shows that you are primarily depended on the credit card and managing expenses through it. Hence, limit your credit card limit.

Close all your previous Loans

Your credit history does reflect your default on old loans. Furthermore, the default also lowers your credit score, eventually resulting in rejection of loan application. If there is any old loan, then make sure to close or settle before applying for a new loan.

For business purposes, you might take new loans but are unable to settle it. So, to get an easy business loan, do settle your previous ones. This will also help in having good CIBIL score to avail loan.

Keeping the Credit Report error-free

There are chances of having errors in the credit report, which you may miss, eventually affecting your CIBIL score. If you have been borrowing a business loan and repaying it on time, then also keep checking credit reports frequently throughout the year.

Some of the errors include default on your payment or mistakes in your name. Ideally, every individual must check the credit score once in a quarter. If there is any mistake, then correct it by logging in to the credit bureau website.

Always check your CIBIL Score before applying for a Loan

If you are applying for a business loan, the best way is to check your credit score or CIBIL score. A good CIBIL score to avail a loan is very much important. This will help in correcting specific issues and know if you are eligible to apply.

Also, get your credit reports 2-3 months before to make improvements. You can even compare the CIBIL score range 2018 or before with current to know the status.

There is no doubt that the CIBIL score is essential, especially if it is high. Better the score, better the chance of getting loans. ZipLoan provides business loans to small-sized companies. So, make sure to have a good CIBIL score for a business loan.

Want to read the latest posts on social media? Then follow us on Facebook, Twitter, and LinkedIn!