You may have heard it way too many times from your friends, family, and colleagues, that their loan application has been rejected because of their low CIBIL Score. And then you nod knowingly, but don’t really check your CIBIL Score, until you have to pursue or avail loans. So, let us take a look at what is CIBIL Score and why is it important in getting loans.

Table of Contents

What is a CIBIL Score?

CIBIL Score is crucial for all sorts of loans for small business, home loans, working capital loans, and loans for small businesses. CIBIL stands for Credit Information Bureau India Limited, a pioneering company that created the concept of CIBIL ratings. These CIBIL scores are all dependent on several factors and apply to individuals and companies of any size and shape.

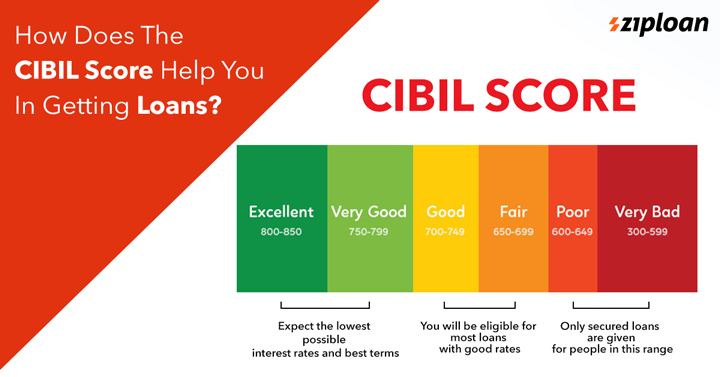

Since CIBIL Score is a prime factor in ensuring and increasing the probability of you to avail loans, it is important to fully understand how to measure it. The CIBIL Score is a three-digit number, which varies from the range 300 to 900. The higher the score, the better it is. CIBIL Score diagnoses your overall financial and credit performance and ascertains your ability to repay the loans.

How is CIBIL Score Measured?

There are four major factors that impact one’s CIBIL Score:

- Payment History: Ensure all your payments are done on time. Making late payments or defaulting on EMIs has a negative impact on your CIBIL Score.

- High Credit Utilisation: A high credit utilisation limit leads to a rising debt burden and may affect negatively on your CIBIL Score.

- Multiple Inquiries: When you inquire for a loan a bit too many times, your CIBIL Score is impacted negatively, as it indicates your credit hungry behaviour and that your loan debt may rise.

- Credit Mix: A healthy distribution among secured loans and unsecured loans leads to a positive impact on your CIBIL Score.

Here’s a breakdown of what is the kind of weightage attributed to each factor for calculation of the CIBIL Score. Past performances on their previous credit, which holds 30% weightage for overall calculation. 25% weightage is held by the type of loan availed, and the duration for which it was availed — the total amount of credit exposure, which also holds 25% weightage. The final 20% weightage is held by current and recent credit usage, and credit utilisation.

Business Loan Eligibility Criteria For An NBFC Business Loan

Why is the CIBIL Score important to Lenders?

The CIBIL score is a clear indicator of how banks and creditors view you as an entity and how inclined would they be to give you the working capital loan that you require to scale up your business. Or the small business loan that would enable you to bring your idea to fruition. The ideal CIBIL score that is the best-case scenario is 750+.

This credit score establishes an absolute trust in you and within the lenders that they may back you with the capital for Loans for small business or creating working capital out of thin air, by taking a working capital loan. With ZipLoan, the process is a three-step and, yet ZipLoan relies on CIBIL score.

What are the Benefits of a good CIBIL Score?

So why should you have an excellent score? As explained earlier, the prime purposes are creating a great first impression! But apart from that, a high score gives you great opportunities to avail cheaper interest rate for business loans. With a high score, you may borrow the working capital loan for a relaxed, longer tenure as well as loans that can be pre-approved. The high CIBIL score also enables quicker approval on credits and loans. So, as an entrepreneur, you can focus on real issues that are getting your work done!

To simply put, CIBIL score is sort of a magic trick, a shield that helps you avail the loans at a much lower rate, faster, and for longer tenures. As an entrepreneur, it gives you an upper hand in negotiation, and wouldn’t we all want an upper hand in all negotiations?

The CIBIL Score can be checked easily using your Pan Card; it is a simple process that takes less than 2 minutes. The score gives one a reality check, as it is an exact measure of how a bank or NBFC views a potential applicant for any kind of loans, including MSME loans. When you do see the score, focus on attempting to improve the score as well as try and rationalise the causes for your lower score. And rectify at the earliest.

Here, at ZipLoan, we require the CIBIL score, and it is a critical factor in our evaluation process for loans. Using the CIBIL score and other factors, we have created a new internal rating system called – the ZipScore, a sophisticated approach to credit rating that ensures the business and its potential is seen in the context beyond CIBIL scores as well!

How to improve the CIBIL Score?

You can check your CIBIL score via the official CIBIL website and undergo a detailed report. It varies from bank to bank and organisation to organisation to account for CIBIL scores. For example, if you have a sub-optimal CIBIL score rating, it may take you 12-18 months to be fully eligible for loans for small business.

To improve your CIBIL score, clear your dues and pay your bills on time. If there’s an EMI, ensure that it is continually paid on time. And well ahead of it, ensure that personal finances and professional finances don’t mix up.

The company and individual should always be represented by a different credit card and debit card. So, a personal lapse in excellent credit health doesn’t affect the business. Apply for new loans in a balanced manner. When done judiciously, it appears that one isn’t seeking excessive credit.

Apart from your personal account, monitor and advise moderation for your joint accounts, authorized accounts, and also your guaranteed accounts as they are equally liable for your financial health. Frequently monitor your credits and check CIBIL Score. Checking your report regularly will also alert you to possible inaccuracies if any. In case you find any errors or misjudgements, you can reach out to CIBIL website to correct the error or ask the lender to log the dispute.

So, that was the importance of factors leading to an excellent CIBIL score. Aim to achieve as high as possible and swiftly apply for working capital loan or a loan for small business with ZipLoan. In a quick 3-step process, you can avail loans and take your business to new heights!

Want to read the latest posts on social media? Then follow us on Facebook, Twitter, and LinkedIn!