One of the nightmares for any finance borrower is repaying of the loan in the form of EMI every month. Depending on the loan amount borrowed, you will need to pay the EMI on the stipulated date every month to the lending company. This instalment you pay takes away half of your profit or saving, which is something you worry.

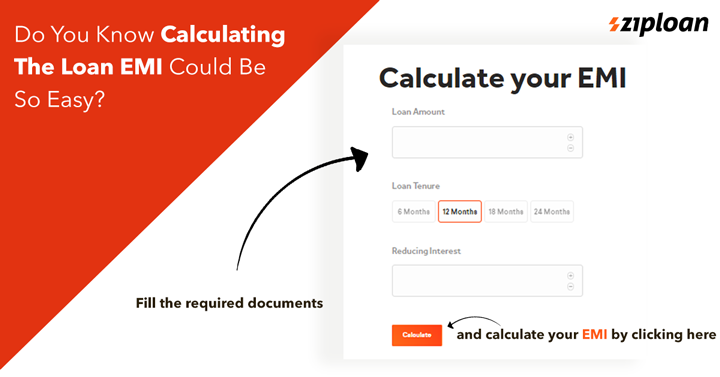

However, to run your business successfully and avoid a penalty, you need to complete the loan tenure on time. Before understanding how much loan EMI you will need to pay, you first need to learn how to calculate EMI by the calculator. Using the business loan EMI calculator online on a website like ZipLoan, you can easily calculate the amount and plan your loan borrowing accordingly.

Before we learn about how to calculate EMI by the calculator, let us learn the basics of EMI and EMI calculator.

Table of Contents

What is an EMI?

As a finance borrower, when you approach the finance company for a business loan, there is a financial agreement between the two parties- a lender and a borrower. Under this financial agreement, the finance company as a lender agrees to lend a loan to the entrepreneur (borrower) for a specified tenure.

EMI (Equated Monthly Instalment) is a particular amount, which you pay to the lender every month until the whole amount is paid off. EMI consists of the interest part and principal to be repaid. In the initial stage, the interest component of EMI is higher, which gradually reduces. To know how much monthly amount you will pay, you can use the EMI calculator for a business loan. Whether you are taking machinery loan or working capital loan, calculating the amount will help you to plan in a better way.

The exact amount allocated towards payment of the principal will entirely depend on the interest rate. You must understand how to calculate the EMI before you opt for the business loan. Being a borrower, you need to be very accurate on how much and how to repay the loan to avoid penalty.

What is an EMI Loan Calculator?

As mentioned above, EMI is a monthly payment, which you need to do as part of loan repayment. It consists of the principal amount and the interest cost. To know the total amount you will pay every month for your business loan, use EMI calculator. You can use this EMI calculator for commercial shop loan or any business loan you borrowed from the finance company.

Earlier, as a borrower, you had to connect with the lender to calculate the EMI. Thankfully, you can now calculate the EMI amount online itself. By using loan EMI calculators, you can enter the variables of the loan like the principal amount, tenure, and the interest rate. Finance companies, including ZipLoan, offers online EMI calculator before you opt for the business loan. This automated tool makes life easier.

How to calculate EMI Loan?

It is quite difficult to calculate EMI manually because the process is quite time-consuming. The formula to calculate EMI is:

- E = P. r. (1+r)^ n/ ((1+r)^ n-1)

- E stands for EMI.

- P stands for principal loan amount in Rupees.

- R stands for rate of interest calculated every month.

- N stands for loan term/tenure/ duration in a number of months.

This formula will be useful when calculating EMI using Excel and mathematical formulas. However, not every user can use this formula accurately. This is why EMI calculators will make your process faster and secure. You need to post your loan amount, tenure, and interest rate.

- Loan Amount: It is the actual amount borrowed for the business purpose. The interest is applied to the principal loan amount. Higher the amount, the higher is the EMI. Therefore, you need to enter the principal amount into the EMI calculator.

- Tenure of the Loan: It refers to the time of the loan repayment. The tenure varies on the principal loan borrowed from the finance company. However, for a small business loan, the tenure is limited to 24 months as the loan amount is less.

- Interest Rate: The interest is a percentage applied on the loan you borrowed at a specific rate. The rate will vary from lender to lender. You should compare the interest rates applied by the lending company.

Below is the short representation of the business loan and EMI calculation:

If you have borrowed Rs. 1 lakh business loan with the interest rate of 13.50%.

For 2 years, the EMI will be Rs. 4778/- interest rate to pay Rs. 30,414/- and the total amount you pay Rs. 1.30 lakhs.

For 3 years, the EMI will be Rs. 3,394/- the interest rate will be Rs. 48,931 and the total amount you pay Rs. 1.49 lakhs.

What is the Loan Amortization Schedule?

Loan Amortization Schedule provides complete details of the loan repayment process. In other words, it offers proper breakup of EMI after calculation you need to pay. To ensure that both interest rate and the principal amount of the loan is paid back wisely, the loan EMI is divided into two parts.

On average, you repay 17-18% of your loan within 1 year of total years of business loan. For instance, if you take a loan of Rs. 10 lakh and decide to prepay your loan by 3 years, you will still need to pay back Rs. 5,00,000 to the bank. This is why you need to have a complete understanding of Amortization schedule.

Benefits of EMI Calculator

There are multiple benefits of using loan EMI calculator. Some of them mentioned below:

- Anytime Access: Online EMI calculator is accessible to the user anytime. Finance lending company like ZipLoan offer easy access to a business loan calculator. You will not need to use mathematical calculation or excel formula.

- Accurate Results: Calculating EMI loan on excel can sometimes offer the wrong result. This can cost you a lot, and it is time-consuming. Online EMI calculator provides error-free calculation.

- Aids Financial Planning Process: Upon calculating the EMI for the business loan, you will end up paying the right amount based on tenure, interest rate, and amount. This will help in financial planning every month.

Finance company like ZipLoan has made life easier for loan borrowers by offering business loan EMI calculator. You can use the EMI calculator before seeking the business loan with proper planning for the expansion purpose.