There are many business loan providers in India who offer loan for business at different terms and conditions. The number of lenders available at disposal sometimes confuses the businessman. He often finds himself in dilemma relating to from whom to avail an MSME loan and which lender will be the best for him. And why not, it is important to avail a business loan from the best business loan provider in India as it can affect the operations of your business.

There are a few factors according to which you can find the right business loan provider for you and your business. Let’s take a look at the factors:

Table of Contents

Eligibility

also read: what are the factors that affect business loan eligibility?

The best business loan providers for you will be the one who offers business loans at basic eligibility criteria. While business loan eligibility criteria are to ensure the lenders are lending to the right borrower who can repay the loan on time. It must also be not that strict that no businessman is able to fulfill it.

You can look for a loan lender who offers MSME loans at the eligibility that you can meet. That said, you must also not look for someone who offers loans to just any businessman. The following is a general eligibility criteria list:

- Business operations for at least 2 years.

- The last filed ITR of more than INR 2.5 lakhs.

- The business turnover of more than INR 10 lakhs.

- The businessman must be between the age 22 and 60 years.

- The businessman must either own a house or business premise.

Documents

also read: how to get business loan without security & Documents in India?

As with the loan eligibility, the documents required by the loans lenders in India must also be very minimal. The best business loan providers are the ones who do not require a long list of documents that it takes the borrower a few days to collect them. A long list of business loan documents may also confuse the borrower.

The following is a generic list of documents required:

- PAN Card

- Identity proof

- Address proof

- ITR (at least last 12 months)

- Bank statement (at least last 12 months)

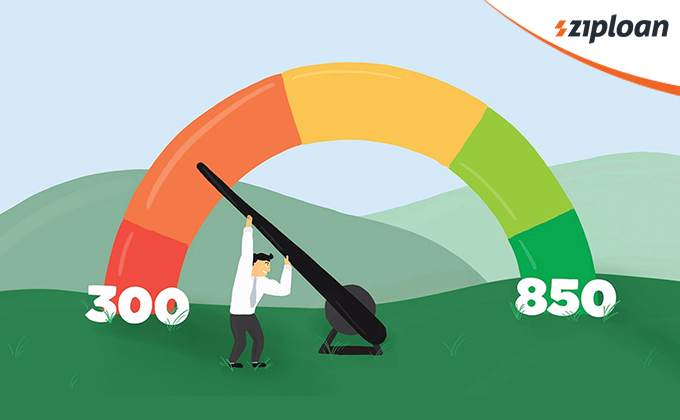

CIBIL Score requirement

also read: how to check cibil score for a business loan?

There is no denying that a high CIBIL score is required to get the loan for business sanctioned. However, a CIBIL score is a general criterion upon which not every businessman’s credibility can be measured. There must be an additional credit evaluation process as well.

So, you can look for business loan providers in Delhi or other Indian cities that employ an additional method to measure the creditworthiness of the businessman in addition to the CIBIL. There are many NBFCs in India that have the different methods.

Different Loan Products

also read: what are the different types o loans for business?

A single loan product cannot be ideal for every businessman. The loan provider offering a range of loan products to its customer can be the best in this terms. The different loan products can be machinery loan, working capital loan, capital loan, flexi loan, term loan, etc. There are many loan lenders who offer different loan products.

You can choose the loan products according to your requirements. And repay it in easy monthly installments.

Now that you know the four important points that can help you find the business loan provider, you can make a smart choice.

Want to read the latest posts on social media? Then follow us on Facebook, Twitter, and LinkedIn!