There are many aspects of the business that needs to be handled by a small business owner when he runs a business. As a small business owner, he doesn’t have resources to waste. But he needs to the optimal performance of every resource/department, so that cost of production is kept at a minimal level. And the profits are also enhanced. But when an individual multi-tasks and handles various functions all by himself, there are chances that some aspects of the business may miss his attention.

One crucial aspect which is often overlooked is the state of finances. Sometimes it might get too late when the business owner realises that something is wrong with his finances. And that the needs external funding to get the business in order.

In such a case, the best option is to avail business loans without collateral from any of the several financial institutions which offer easy small business loans in Delhi-NCR and other regions in India. A small business owner can get access to external funding by filing a business loan application and providing all the required documents.

Business Loans Without Collateral

Business loans without collateral, also known as unsecured business loans, are a financial product that offers business owners easy access to funds in an emergency, without hypothecating any security or collateral.

So, as there is no hypothecation of assets involved, the processing time for a business loan application is very less. Nevertheless, in most cases, the application is processed and disbursed within a few working days.

With an extended repayment period of up to 24 months, it is convenient for business owners to repay the business loan amount through easy EMIs. The amount borrowed as the loan amount can be used for any business-related requirement of the borrower. Such as for the payment of taxes, bills, infrastructure/machinery up-gradation, labour wages, etc.

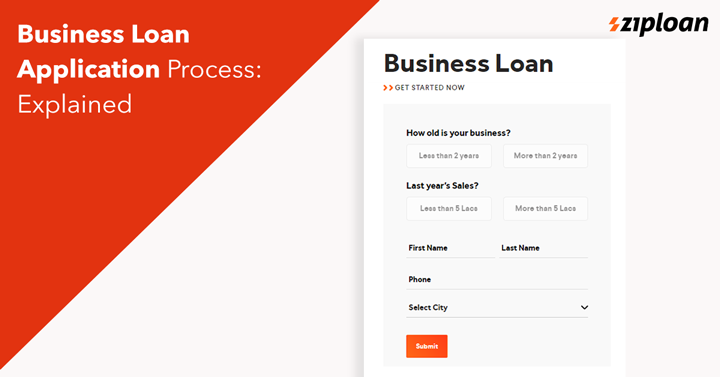

With the rising integration of technology in the financial services sector, an entrepreneur can now conveniently apply for business loans without collateral through online financial marketplaces in terms of company websites. While searching online, the applicant can have access to the complete information about various financial products. Thus, he can select the ideal one for his business. Besides, when he applies for a business loan online, he enjoys the benefits of quick processing and disbursals.

Business Loan Applications Process

Most of the times when an applicant applies for a business loan, he is only interested in the final outcome of the process, i.e., loan amount. But it is equally vital for him to understand the entire application process. This knowledge would come in handy as he would be able to address the shortcomings beforehand so that there are no issues faced while processing the business loan application.

Let’s now take a look at a few steps involved in the process followed by most financial institutions for processing an application for a business loan:

-

The business owner first has to apply to the financial institution of his choice through online or offline channels. Notably, he can choose the channel as per his convenience. When he applies, he has to submit the copies of his KYC and financial documents.

-

The financial institution or online lender would first check the CIBIL score as well as the company’s CIBIL score. Ideally, the CIBIL score should be over 750 as it signifies financial discipline on the applicant’s behalf. But, it does not mean that if the CIBIL is below 700, the business loan application would not be approved. There are many lenders who weight in other factors as well in addition to the CIBIL to determine the business loan eligibility.

-

After taking care of the CIBIL, the online lender moves on to the analysis of the submitted financials. The representative would check the Income Tax returns, Net Worth Statements, and Bank statements to ascertain the financial strength of the business.

-

If any further documents are required, the same will be communicated with the applicant through an email or SMS.

-

Then, the financial institution would initiate the verification process. This involves a visit to the business place as well as the residence. The applicant can also be asked to provide certain documents.

-

Then, the online lender would call the personal and business references that are provided in the loan application to ascertain the reputation in the market. So, it is vital to provide references of the person(s) who can provide the right information.

-

Finally, there will be a personal discussion (PD) with the credit manager of the lending institution. The credit manager will ask questions that he/she might have.

-

If the application is approved, the representative from the financial institution will come to get the loan disbursal kit signed from the applicant along with the cancelled Provide post-dated cheques for an account which is active and operative.

-

After signing the kit, the business owner can expect the amount to be credited in his bank account within a couple of working days.

With the option for easy small business loans, it is now convenient for the small business owners to take control of their finances and meet their liabilities in a timely manner.

Want to read the latest posts on social media? Then follow us on Facebook, Twitter, and LinkedIn!