Filling the loan application form is the first step towards applying for a business loan. Irrespective of the lender, whether a bank or an NBFC, it is an important step. From the loan lender’s point of view, assessment of risk and thoroughness in documents are two crucial factors. Hence, it is imperative for the MSMEs to know about the KYC documents and business financial required just as much as knowing their loan requirements.

A business loan application is submitted along with the necessary KYC documents and business documents. The paperwork is essential to indicate the creditworthiness and ability to repay the loan amount. Notably, if all the supporting documents are submitted on time, the business loan application is processed faster. Additionally, this also inspires confidence and trust in the lender.

Let’s now take a look at the KYC and business documents required by the loan lender.

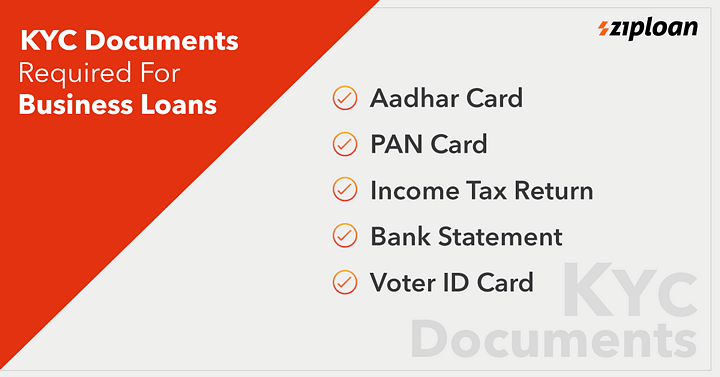

KYC Documents

Some of the most commonly required KYC documents are as mentioned below:

- Business Entity Proof: incorporation certificate, Articles of Association (AOA), Business Establishment Certificate, Partnership Deed, etc.

- PAN Cards: that of the business entity as well as the partners/proprietors/directors/promoters.

- Address Proof: residence place and business premises.

Notably, all these documents should be self-attested (the applicant needs to sign on the photocopy of the documents). The other required documents include:

- Previous year ITR

- Bank statement of more than nine months

- PAN card and Aadhar Card

Now let’s take a look at the eligibility for a business loan in India:

Business Loan Eligibility

| Age | More than 25 years and less than 55 years.

(If the applicant is less or more than 25 and 55 years respectively, a co-applicant is mandatory) |

| Business Ownership | Document: Electricity bill / Water bill / House Tax / Gas Pipeline Bill |

| Business Vintage | More than 2 years

Documents: ITR / GST / TIN / VAT / Sales Tax / Current Account |

| Business Turnover | More than 10 lakhs in the previous year |

| Bank Statement | For nine months |

| Business Place | Either home or business place should be owned by the business owner |

| CIBIL Score | CIBIL history should be more than five years, or co-applicant will be required. |

If the business owner wants to avail an unsecured business loan, an NBFC is the best option. They ensure that the funds are transferred within a few working days. Also, they offer business loans at basic eligibility criteria and minimal documentation. NBFCs have trouble-free customer policies, and they provide an online loan application form. Simplistic loan terms and conditions and facile document requirement make NBFCs the best option.

Want to read the latest posts on social media? Then follow us on Facebook, Twitter, and LinkedIn!